- Home

- »

- Competition Exam

- »

- Talent Search Exam

- »

- IAA NATS 2020-21 National...

IAA NATS 2020-21 National Accounting Talent Search : accountingtalent.org

Organisation : Indian Accounting Association (IAA)

Contest Name : NATS National Accounting Talent Search 2020-21

Applicable For : UG Students

Registration Last Date : 12.01.2021

Website : https://www.accountingtalent.org/

| Want to comment on this post? Go to bottom of this page. |

|---|

IAA NATS

National Accounting Talent Search 2020-21 is an Accounting Knowledge Competition organised by Indian Accounting Association.

Who Can Participate?

Junior Level :

Any student doing B.com, BBA, BBM or any other undergraduate course

Senior Level:

Any person below the age of 25 years as on July 1, 2019 (born after June 30, 1994)

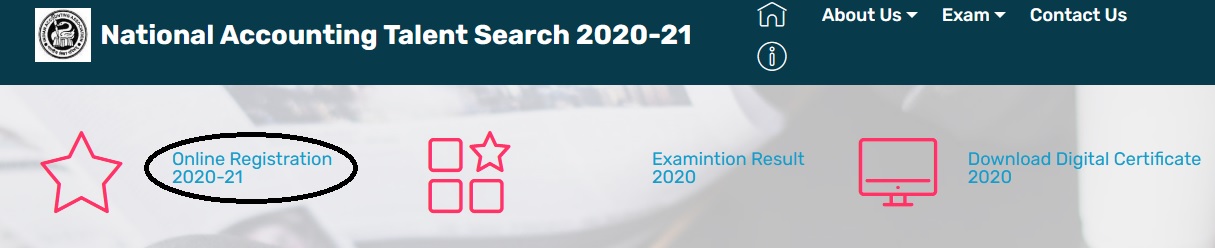

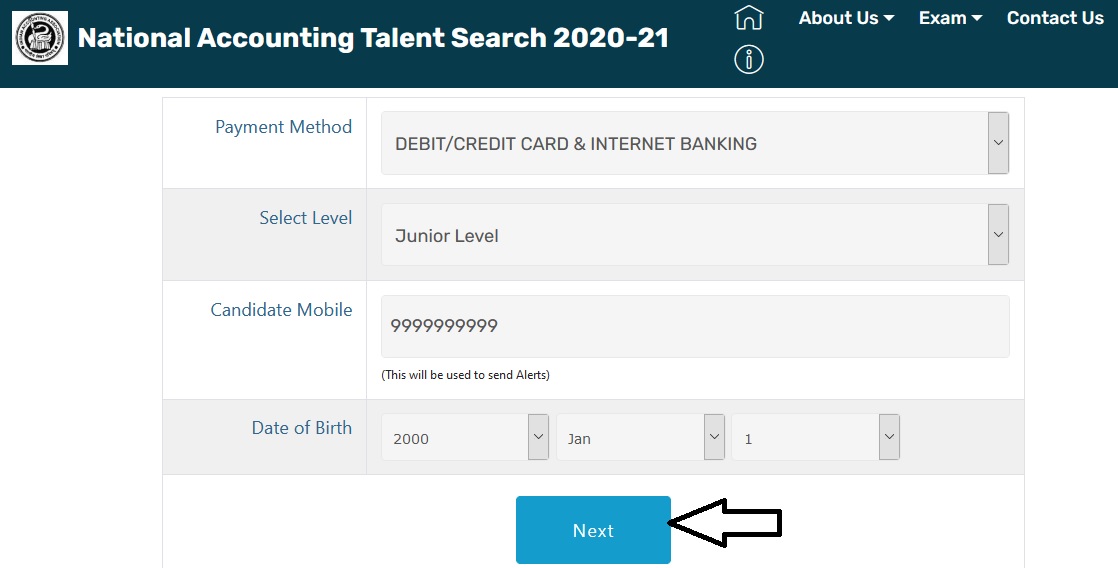

How To Apply?

Please make payment of Rs. 250 (Junior Level) / Rs 500 (Senior Level) for Registration Form and submit details in online Registration Form.

Register Here : https://www.accountingtalent.org/step1.php

Registration Fee

Junior Level : Rs. 250

Senior Level : Rs. 500

Online Payment

** Deposit Rs Amount in any branch of State Bank of Bikaner and Jaipur in account of Coordinator, National Accounting Talent Search (Account No 61060736681), No bank charges are to be paid. (or)

** Send a Demand Draft in Favour of Coordinator, National Accounting Talent Search payable at Udaipur Rajasthan and send it to Prof. G. Soral, Coordinator, National Accounting Talent Search, Department of Accountancy and Statistics, UCCMS, Mohanlal Sukhadia University, Udaipur- 313 001 Rajasthan

** You can make payment online via Debit-card/Credit Card and NetBanking, We accept all banks cards.

Exam Pattern

The competition shall have the following format,

** 100 multiple-choice questions to be attempted during 90 minutes.

** 4 marks awarded for every correct answer and 1 mark deducted for every wrong answer.

Course Coverage

Junior Level

** Financial Accounting Cycle including Journal, Day Books, Ledger, Trial Balance, Adjustment Entries, Final Accounts, Rectification of Errors,

** Bank Reconciliation Statement, Depreciation Accounting, Accounting for Non-Profit Making Organizations, Accounting for consignment and joint venture, insurance claims.

** Partnership Accounts, Accounting for issue, reissue and forfeiture of shares, issue and redemption of preference shares and debentures.

** Costing Concepts, elements and Classification of Cost, Unit Costing.

** Elementary knowledge of IND AS

Senior Level

** Financial & Management Accounting

** Basic Accounting concepts, Capital and Revenue, Financial statements

** Partnership Accounts: Admission, Retirement, Death, Dissolution and Cash Distribution.

** Advanced Company Accounts: Issue, forfeiture, Purchase of Business, Liquidation, Valuation of shares, Amalgamation, Absorption and Reconstruction, Holding Company Accounts.

** Cost and Management Accounting: Ratio Analysis, Funds Flow Analysis, Cash Flow Analysis, Marginal costing and Break-even analysis, Standard costing, Budgetary control, Costing for decision-making.

** Responsibility accounting

Business Statistics :

** Data types, Data collection and analysis, sampling need, errors and methods of sampling, Normal distribution, Hypothesis testing, Analysis and Interpretation of Data.

** Correlation and Regression, small sample tests-t-test, F-test and chi-square test.

** Financial Management

** Capital Structure, Financial and Operating leverage

** Cost of capital, Capital budgeting

** Working capital management

** Dividend Policy

Advanced Accounting & Finance :

** Accounting standards : IND AS and IFRS, Responsibility Accounting, Social Accounting.

** Money and Capital market, Working of stock exchanges in India, NSE, OTCEI, NASDAQ, Derivatives and Options.

** Regulatory Authorities : SEBI, Ratting Agencies; New Instruments : GDRs, ADRs

** Venture Capital Funds, Mergers and Acquisitions, Mutual Funds, Lease Financing, Factoring, Measurement of risk and returns, securities and portfolios

Income Tax & Tax Planning :

** Basic concepts, Residential status and tax incidence, exempted incomes, computation of taxable income under various heads.

** Computation of taxable income of individuals and firms.

** Deduction of tax, filing of returns, different types of assessment; Defaults and penalties.

** Tax planning : Concepts, significance and problems of tax planning, Tax evasion and tax avoidance, methods of tax planning.

** Tax considerations in specific business decisions, viz., make or buy; own or lease, retain or replace; export or domestic sales; shut-down or closure; expand or contract; invest or disinvest

** Computer Application in Income Tax and Tax Planning.

Awards

| Position | Junior Level | Senior Level |

| Best Performance | Rs. 10,000 + Trophy + Certificate | Rs. 15,000 + Trophy + Certificate |

| Second Best Performance | Rs. 5,000 + Trophy + Certificate | Rs. 8,000 + Trophy + Certificate |

| Third Best Performance | Rs. 3,000 + Trophy + Certificate | Rs. 4,000 + Trophy + Certificate |

| Outstanding Performance | Rs. 1,500 + Certificate | Rs. 2,000 + Certificate |

| Brilliant Performance | Certificate | Certificate |

| Rank from 50th to 90th percentile | Certificate | Certificate |

| Rank below 50th percentile | Certificate of participation | Certificate of participation |

| Centre Topper | Rs 1,000 + Trophy + Certificate | ——– |

| Brilliant Performance | Certificate | Certificate |